Who is a member?

Our members are the local governments of Massachusetts and their elected and appointed leadership.

From the Beacon, February 2022

As the Legislature sets priorities for early action during the next two months, two critical municipal needs deserve to rise to the top of the agenda: a full and fair increase for local aid in the fiscal 2023 state budget, and enactment of a $300 million Chapter 90 bond bill for the repair and upkeep of local roads.

A fair increase for Unrestricted General Government Aid is essential

With property taxes tightly capped by Proposition 2½, cities and towns rely on predictable and adequate state revenue sharing to provide municipal and school services, ensure safe streets and neighborhoods, and maintain vital infrastructure. These services are fundamental to our state’s economic recovery, success and competitiveness.

Unrestricted General Government Aid is the revenue sharing program that cities and towns receive to fund these essential municipal services. The target is for UGGA to increase by the same percentage as the growth in state tax revenues, so that communities receive a fair increase each year.

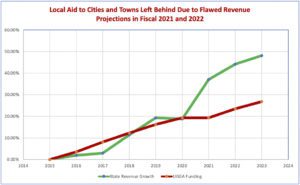

As you can see from the accompanying chart, before the pandemic this policy worked well. Overall, state revenues and UGGA each grew by 19% in the five-year stretch from fiscal 2015 to 2020, with a small variation from year to year. The past two years, however, have seen an unprecedented divergence between state revenues and local aid funding. In fiscal 2021 and 2022, state tax collections have increased by $6.32 billion, 21.3% over the amount collected in fiscal 2020. During this time, UGGA has been left behind, receiving only a 3.55% increase of $39.5 million. This breakdown needs to be addressed.

Given all the uncertainty, it’s understandable that the state’s financial windfall was difficult to predict in the early months of the pandemic. However, this now-recognized inequity must be addressed and solved as a key budget priority in fiscal 2023. Otherwise, the state will fail to live up to its revenue sharing commitment, and cities and towns will be permanently impaired by a far-too-low discretionary aid funding base, causing greater reliance on capped property taxes and locking communities in a fiscal vise that will continually squeeze out funding for essential municipal and school services in the coming years.

The fiscal 2023 budget filed by Gov. Charlie Baker falls far short of what’s needed, offering only a $31.5 million increase in the UGGA account, a below-inflation increase of 2.7% over fiscal 2022 levels. As we stated during the MMA’s Annual Meeting last month, a 2.7% increase is too low. What is needed is a local aid investment that reflects the actual growth in revenues that the state is receiving.

The administration is calculating revenue growth using a methodology that omits a large portion of the record-setting revenue collections that the state has experienced during the past year. This way of benchmarking growth disadvantages cities and towns. Fiscal 2023 state tax collections will be $2.5 billion higher (7.3%) than the $34.4 billion tax base that was used to pass the fiscal 2022 budget last July, and $6.8 billion higher (22%) than the original fiscal 2022 revenue projection from a year ago. The administration is using the highest possible revenue estimate for fiscal 2022 ($35.95 billion, set just two weeks ago), and relegating UGGA to an artificially low growth projection, even though actual growth will be much higher.

The accurate and fair way to fund UGGA in the fiscal 2023 budget would be to increase municipal aid by 7.3%, or $85.3 million, in fiscal 2023 — not $31.5 million — by using a common-sense approach that compares expected fiscal 2023 revenues of $36.9 billion with the $34.4 billion amount used to pass the fiscal 2022 budget in July.

It is important to note that while cities and towns have welcomed much-needed federal American Rescue Plan Act funding to respond to and recover from the pandemic, this is one-time funding that can only be used in accordance with federal guidelines. As such, it cannot be seen as an alternative to state funding to support local aid and key operational programs.

This is a critical time for cities and towns, our residents, and our economy. Every region of the state is facing hardships and challenges. In terms of restoring fiscal stability at the municipal level and ensuring adequate funding for essential local services, the critical first step will be returning to full revenue sharing in fiscal 2023.

Timing is also essential. Cities and towns are drafting their budgets now and will be adopting them at town meetings and council meetings well before the final state budget is enacted in July. Communities will need an early commitment from lawmakers to a full revenue sharing increase so these funds can be planned for and used to maintain core services. Fairness and timing are both critical.

Chapter 90 needs a long-overdue increase

The second front-burner issue is quick passage of a $300 million Chapter 90 bond bill, so that cities and towns can move forward to maintain, repair and rebuild their 30,000 miles of municipal roadways in Massachusetts.

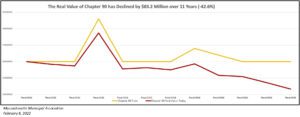

The MMA’s biennial survey on gaps in local road funding across the state shows that communities need $600 million to adequately fund municipal road and bridge projects in a state of good repair. Current Chapter 90 funding, stuck at $200 million annually, the same amount received in fiscal 2012, supports only one-third of this need. Further, more than three-quarters of survey respondents reported that they have had to save up Chapter 90 funds over the past five years to cover the cost of necessary road projects that exceed their annual allotment.

Chapter 90 bond-funded allocations have been generally flat at $200 million since fiscal 2012, which is why local leaders are disappointed that the administration has simply re-filed a $200 million proposal for the coming year, instead of recognizing that this is far short of the mark. The stark reality is that the purchasing power of the Chapter 90 program has been substantially diminished since fiscal 2012. With Chapter 90 remaining at $200 million for fiscal 2022, the real (inflation-adjusted) level of state support for local road projects has dropped by 40%, to an inflation-adjusted $120 million. That is a loss of $80 million in purchasing power over the past 10 years.

Communities desperately need Chapter 90 to increase to $300 million. Otherwise, cities and towns will continue to fall further behind each year, and our local roads will continue to crumble.

Swift passage is key as well. Cities and towns cannot award contracts based on Chapter 90 reimbursements until official notifications are received, and late passage of the Chapter 90 bond bill in recent years has forced communities to bid, award and start work on projects in a significantly shortened timeline, compressing the construction season, driving up the cost of projects due to more expensive bid responses, and reducing the scope of work accomplished.

This is one of the reasons why a multiyear bill would be a great improvement, as this would avoid a process that lurches from year to year, and thus improve the ability to plan at the local level.

With a tightly capped property tax, communities do not have the resources to close the massive $400 million gap between what is needed for local roads and the current level of Chapter 90 funding. Further, federal ARPA funds can’t be spent on road or transportation infrastructure projects, and the new federal infrastructure law signed late last year is reserved for very large state and regional projects.

Increasing the bond authorization to $300 million annually is an important and necessary step to keep municipal roads safe and in good condition, and support local businesses and economies in all parts of the state. These funds would be put to work immediately and contribute to the state’s economic recovery.

The bottom line is clear: local leaders are looking to their partners in the Legislature. Community leaders are asking state lawmakers to give top priority to the revenue and investments needed to deliver essential municipal services and fund our municipal transportation networks.

The coming weeks will determine whether cities and towns will have the resources they need to serve the people of Massachusetts. The answer will shape our recovery and prosperity in the years ahead.