Who is a member?

Our members are the local governments of Massachusetts and their elected and appointed leadership.

His Excellency Charles D. Baker

Governor of the Commonwealth

State House, Boston

Delivered Electronically

Dear Governor Baker,

On behalf of the cities and towns of the Commonwealth, the Massachusetts Municipal Association deeply appreciates your unwavering support for local government. We look forward to working with you and the Legislature in developing a state spending plan for fiscal 2023 that supports municipal revenue and spending needs at the local level, and moves the communities of Massachusetts forward during a time of great anxiety and volatility.

With a tightly capped property tax that limits municipal revenues, cities and towns require predictable and adequate state revenue sharing in order to provide world-class municipal and education services, ensure safe streets and neighborhoods, and maintain local roads and vital infrastructure. These services are fundamental to our state’s economic recovery, success and competitiveness.

While cities and towns have welcomed much-needed federal relief funding to respond to and recover from the pandemic, municipal leaders recognize that this is one-time funding that only can be used in accordance with federal guidelines. As such, it cannot be seen as an alternative to state investment and support for local aid and key operational programs.

We are writing today to address the specific issue of ensuring equitable and adequate revenue sharing through Unrestricted General Government Aid (UGGA), which is the only source of discretionary funding for cities and towns to support municipal budgets. We will highlight other key budget priorities in a separate letter later this week.

The Problem: Unrestricted General Government Aid Is Seriously Lagging Behind

Recognizing that the Commonwealth has collected near-record growth in tax receipts over the past two fiscal years, we strongly support a significant increase in the Unrestricted General Government Aid account (1233-2350). The MMA and local officials across the state deeply appreciate that you and your Administration have committed to revenue sharing as a fundamental value in your financial planning and budgeting. Since you first took office in 2015, your state budget submissions have promised to equitably share state tax revenue growth with cities and towns by tying the percentage increase of Unrestricted General Government Aid to that of state revenue growth.

Your budgets have used the consensus revenue forecasting process as the means of calculating the percentage growth in state tax revenues from year to year. Each January, the Legislature and Administration have reached agreement on revenue estimates for the following fiscal year, which closes 18 months later. There often is some variation between estimated and actual revenues, but in normal times these work out over the long term. However, state tax revenues have far exceeded the consensus forecasts during fiscal 2021 and 2022, creating a huge disparity in the amount of UGGA aid that communities are receiving, compared to the growth in the state’s fiscal resources.

In fiscal years 2021 and 2022, state tax collections are estimated to have increased by $6.54 billion, an increase of 22.1% over the amount collected in fiscal 2020.1 However, during this time UGGA has only received a 3.55% increase of $39.5 million. It’s understandable that the state’s financial windfall was difficult to predict in the early months of the pandemic, given all the uncertainty. However, this inequity must be addressed as a key budget priority in fiscal 2023. Otherwise, the state will fail to live up to its revenue sharing commitment, and cities and towns will be permanently impaired by a far-too-low discretionary aid funding base. The result will be even greater reliance on capped property taxes, locking communities in a fiscal vise that will continually squeeze out funding for essential municipal and school services in the coming years.

The Solution: Using an Equitable Growth Calculation for Fiscal 2023

In general, the method for estimating state tax revenue growth and UGGA funding has been set each January in your proposed general appropriations act, using the consensus revenue forecast for the next fiscal year and the most recent (revised) consensus revenue estimate for the current year. That percentage growth estimate has been used to calculate the revenue sharing increase for UGGA.

However, using the most recent revised revenue estimate for fiscal 2022 as the base would exclude a massive amount of the Commonwealth’s revenue growth, and lock municipalities out of their fair share of this financial success. For this reason, it is imperative that your House 2 proposal use a growth calculation that reflects the growth in tax revenues compared to original — not revised — estimates.

Knowing that time is of the essence, and that the official consensus revenue estimate is not due until January 15, with the deadline for filing House 2 with the Legislature shortly thereafter, the MMA will illustrate the impact of various scenarios using the midpoint of revenue estimates for fiscal years 2022 and 2023 in testimony submitted by Department of Revenue Commissioner Geoffrey Snyder at the December 21 Consensus Revenue Hearing, as well as the actual receipts for fiscal 2020 and 2021.

In the DOR’s testimony, state tax revenues are estimated as follows: $37.084B in fiscal 2023; $36.176B in fiscal 2022 (which is higher than the $34.401 revision by A&F in Aug. 2021); $34.170B in fiscal 2021; and $29.633B in fiscal 2020.

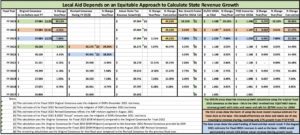

Using these amounts, the chart below shows state tax revenue collections increasing by 15.47% from fiscal 2017 to 2020, and UGGA increasing by 10.48% during the same time period. However, after the massive revenue growth in fiscal years 2021 and 2022, overall tax collections have increased by 40.97% between fiscal 2017 and 2022, yet UGGA has only increased by 14.4%. A 5% revenue sharing gap has become a 26.57% breakdown in just two years. A significant adjustment must be made now to correct the discrepancy and return balance to the revenue sharing compact.

There are three policy scenarios illustrated below. The first, in green, proposes that House 2 estimates revenue growth by using the original consensus estimate for fiscal 2022 as the base. This represents growth of 23.12%, resulting in an UGGA increase of $270 million, resetting revenue sharing to closely match growth over time (44.51% state tax growth, 40.85% UGGA growth). The MMA is urgently requesting that your fiscal 2023 budget submission include $1.438 billion for Unrestricted General Government Aid. Without this appropriation, these funds will be marbled into state agency funding, and it will be exceedingly difficult, if not impossible, to close the revenue-sharing gap in future years, permanently impairing local aid levels.

The two remaining scenarios, in red and blue, respectively, show the shortcomings of using revised fiscal 2022 revenue estimates as the base to measure revenue growth. The red highlights show the impact of using the most recent revision to the fiscal 2022 estimate (DOR on December 21) as the base. If this is the calculation, projected revenue growth from fiscal 2022 to 2023 would be just 2.51%, and UGGA would only see a $29 million increase. Thus, from fiscal 2017 to 2023 state tax revenues would grow by 44.51%, yet discretionary aid to cities and towns would go up by just 17.27%. Using A&F’s August 2021 revised estimate, shown in blue, would yield a similar result, with a slightly larger revenue growth calculation of 7.8%. Yet this would suppress UGGA’s 2017-2023 growth to 23.32%, far behind the equitable revenue sharing target of 44.51%.

Setting an equitable reflection of state tax growth is a top priority for cities and towns, because that would ensure an equitable revenue sharing amount for Unrestricted General Government Aid. As referenced at the state’s revenue hearing, despite strong state revenue growth, multiple factors continue to contribute to economic uncertainty. These factors, including labor and workforce shortages, the impact of inflation, and supply chain disruptions, are all having a major impact at the municipal level as well, making it harder to deliver the vital local services that our residents and businesses depend on. Local aid funding must be increased so that our communities can meet these challenges.

In terms of affordability, the MMA is requesting a prospective UGGA increase of $270 million in the fiscal 2023 state budget. We are not asking for a retroactive increase to make up for lost local aid levels, as that is a question for mid-year budgets. If UGGA had been adjusted to track the state’s 22.1% revenue growth in fiscal 2021 and 2022, then UGGA levels would already be $250 million higher today. In that context, the MMA’s request is certainly a moderate and equitable approach for both local and state government, ensuring fiscal stability for each partner.

Summary

This is a critical time for cities and towns, our residents, and our economy. We know that you and Lt. Governor Karyn Polito are outstanding partners for communities across the Commonwealth, and we look forward to working with you to ensure that every region of the state recovers from the hardships and challenges of the past two years. In terms of restoring fiscal stability at the municipal level and ensuring adequate funding for essential local services, we believe the critical first step will be returning to full revenue sharing in fiscal 2023.

We thank you very much for your support, dedication and commitment to the cities and towns of Massachusetts.

Sincerely,

Geoffrey C. Beckwith

MMA Executive Director & CEO

CC:

The Honorable Karyn Polito, Lieutenant Governor of the Commonwealth

Secretary Michael J. Heffernan, Executive Office for Administration and Finance

Undersecretary Catharine Hornby, Executive Office for Administration and Finance

Senior Deputy Commissioner Sean Cronin, Division of Local Services