Who is a member?

Our members are the local governments of Massachusetts and their elected and appointed leadership.

MMA Executive Director Geoff Beckwith (left) speaks at a budget hearing on education and local aid on March 13 at UMass Amherst. Also testifying were (l-r) Franklin Regional Council of Governments Executive Director Linda Dunlavy, Athol Town Manager Shaun Suhoski, and Amherst Town Council President Lynn Griesemer.

At a major legislative budget hearing on education and local aid on March 13, the MMA and local officials called for a new state revenue-sharing plan that would better reflect the state’s robust revenue collections of recent years and help cash-strapped cities and towns provide essential local services.

MMA Executive Director Geoff Beckwith said the 2% increase in unrestricted local aid in the governor’s fiscal 2024 budget proposal is “too low” given that cities and towns face escalating costs and a tight cap on local revenues.

“It is so far below inflation and the general costs that communities are struggling with, that it would backslide communities’ ability to support essential municipal services,” he told members of the House and Senate Ways and Means committees during the hearing, held at UMass Amherst.

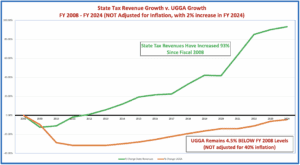

Since fiscal 2021, he said, state revenues have grown by 18.38%, far surpassing expectations, but Unrestricted General Government Aid, the state’s main revenue-sharing mechanism, would grow by just 11.3% over that period if the Legislature goes along with the governor’s UGGA proposal for fiscal 2024.

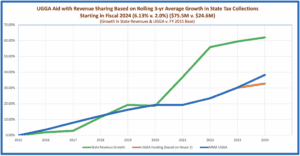

Beckwith proposed that legislators use a three-year rolling average of state tax revenue growth, rather than the projected growth for a single year, as a baseline for setting UGGA increases, which he said would smooth out peaks and valleys in UGGA proposals and provide more predictability for cities and towns. Using this method would increase UGGA by 6.13% ($75.5 million) for fiscal 2024, he said.

The proposed increase, he said, would still leave UGGA funding slightly below where it was 16 years ago, in fiscal 2008, and “that’s not even figuring in the impacts of inflation, which is about 40% during that time.”

State tax collections have grown by 93% since fiscal 2008, while Unrestricted General Government Aid remains below where it was 16 years ago.

Joining Beckwith was Athol Town Manager Shaun Suhoski, the chair of Small Town Administrators of Massachusetts, and Amherst Town Council President Lynn Griesemer. Suhoski pointed out that cities and towns provide essential services, including public safety, public works, education, senior services, and snow and ice removal, but that they “are limited on property tax collections and rely on state aid that the Commonwealth provides to stay strong and viable.”

“Two percent is insufficient,” he said, “and we are robbing Peter to pay Paul.”

Using a three-year rolling average of state revenue growth to set UGGA increases would begin to close the gap between robust state growth and local aid.

The MMA also submitted written testimony outlining municipal priorities for the fiscal 2024 state budget.

Chapter 70

The governor’s budget proposal, known as House 1, would increase Chapter 70 school aid by $586 million for fiscal 2024, fulfilling commitments in the Student Opportunity Act, and funding year three of six of the law’s intended implementation schedule.

Beckwith noted, however, that 37% of operating districts (119 out of 318) would receive only the minimum per-student increase of $30 in the Student Opportunity Act, providing those districts with a Chapter 70 increase of just 0.7%, far below inflation. These 119 districts would receive a combined increase of $7.7 million, and the remaining districts would receive $578 million.

The MMA continued its strong advocacy for minimum aid of $100 per student to ensure that all districts can at least keep pace with inflation and maintain school services. Bringing all districts up to the $100 per student threshold would only require an additional $18.8 million.

“The governor’s budget proposes a significant increase (in Chapter 70), but it doesn’t benefit us,” Griesemer said. “With regard to school aid, like every other community, we are not keeping up.”

The MMA also asked the Ways and Means committee members to consider another aspect of Chapter 70: the very high increase in mandated local contributions in the foundation budget formula. Beckwith pointed out that state-mandated increases in local education spending far outpace the growth in local revenues in recent years, which is putting a major strain on all municipal budgets.

“All types of communities are impacted,” he said, “whether they are major beneficiaries of the Student Opportunity Act or they are minimum aid districts.”

Special Education Circuit Breaker

The MMA expressed support for the governor’s proposal to fund the Special Education Circuit Breaker program at $503 million. The MMA asked for full funding of the state’s share of eligible educational costs with the schedule included in the Student Opportunity Act, which added transportation expenses as an eligible cost.

The MMA and local officials shared the urgency of finding a solution to a decision by the Operational Services Division to allow private special education schools to increase their tuition rates by 14% in fiscal 2024. The estimated cost of this increase, based on the current number of students statewide placed in private special education schools, is $92.8 million. Local officials suggested a two-pronged approach, addressing future reimbursement through the Circuit Breaker program, but also addressing the urgent need for additional funding for the upcoming fiscal year.

Charter School Impact Mitigation Payments

The governor’s budget would increase the charter school reimbursement account to $243 million, intended to meet the commitment in the Student Opportunity Act to fund 100% of the state’s statutory obligation to mitigate Chapter 70 losses to charter schools.

Beckwith thanked legislators for accelerating the reimbursement rate in fiscal 2023, which fulfilled the state’s statutory obligation one year ahead of schedule. He noted, however, that charter schools continue to divert a high percentage of Chapter 70 funds away from many municipally operated school districts, and place increasing strain on the districts that serve the vast majority of public schoolchildren. The MMA reiterated its call for comprehensive charter school finance reform.

Student transportation

House 1 would fund approximately 90% of regional transportation costs at $97 million. Not fully funding this account creates a hardship for virtually all communities in regional districts.

“If you can get to 100% reimbursement,” Suhoski said, “that would help so many rural districts, some of which are sprawling.”

Reimbursements for transportation of out-of-district vocational students would receive a significant increase in House 1, bringing reimbursements up to 90% for the first-time in many years, which Beckwith applauded, while also asking that the Legislature consider fully funding the account.

The governor’s budget reflects full funding for transportation of homeless students under the federal McKinney-Vento Act at $28.6 million.

Rural schools

The governor’s proposal would increase rural school aid by $2 million, bringing the account to $7.5 million. Beckwith expressed appreciation for the increase, but explained that it still falls short of the $60 million recommendation included in last summer’s report from the Commission on the Fiscal Health of Rural School Districts.

Payments In Lieu Of Taxes (PILOT)

The governor’s budget would fund payments-in-lieu-of-taxes at $51.5 million. According to the administration, this amount would hold municipalities harmless from recent valuations. In fiscal 2023, the Legislature increased this account by 29% over the prior year. Beckwith acknowledged the progress that has been made on PILOT in the last two years, and asked that legislators continue to support this important funding for municipalities.

Municipal Regionalization and Efficiencies Reserve

The governor’s budget proposal includes funding for several key initiatives that assist cities and towns. This reserve would provide $8 million to the Community Compact Program, $5 million in public safety staffing grants, $3 million for technical assistance through regional planning agencies, $2 million for regionalization and efficiency programs, $2 million to assist communities in identifying and applying for new federal grants, and $500,000 for the Local Finance Commonwealth Fellowship Program.

Process

The House and Senate Ways and Means committees jointly hold a series of hearings in March and early April on various areas of the state budget.

The House is expected to draft and debate its budget bill in April, with the Senate deliberating its own bill in May.

The Legislature will work to get a final budget bill to the governor by the beginning of the fiscal year on July 1.